The sooner you start planning for retirement, the better off you’re going to be in the long run. Even if it’s just a tiny bit that you save towards your retirement, it’s going to make a big difference! Judd Carlton is a financial advisor serving families, individuals, and businesses in Morristown, NJ. He explains the importance of thinking about retirement as soon as possible. Then, we dive into the more financial aspects of your practice. For instance, if have a group practice, Judd describes why you may want to create either a 401(k) for your employees or some other retirement plan within your practice. Plus, Judd reveals the differences between SEP IRA & SIMPLE IRA Plans.

Meet Judd Carlton

Judd Carlton is a financial advisor serving families, individuals, and businesses in Morristown, NJ, and beyond. He specializes in finance for business owners and mental health professionals, helping them align the finances of their practice with their long-term financial planning and investment objectives.

Judd Carlton is a financial advisor serving families, individuals, and businesses in Morristown, NJ, and beyond. He specializes in finance for business owners and mental health professionals, helping them align the finances of their practice with their long-term financial planning and investment objectives.

Judd graduated Magna Cum Laude from New York University with a BA in Economics and has an MS in Accounting from the Silberman College of Business at Fairleigh Dickinson University. He also holds the CFP® and AIF ® designations.

Judd is also a husband, father of three girls, and dog dad. He posts, blogs, and makes YouTube videos on financial subjects that may be of interest to business owners, psychologists, psychiatrists, and mental health group practice owners.

Think About Retirement Early

It’s essential to start thinking early about retirement because, in the world of investing, time is on your side when you have a lot of it. The earlier you get started then, the better things will work out for you because of the power of compounding. Even starting five years or ten years sooner can make a huge difference. As you change and develop in your career, you might jump from an employee role to a self-employed role; then, the complication accelerates. The wise choice when it comes to investing in your retirement is to be conservative. You never want to have an issue or feel stressed about money. Once you cross those hurdles, it’s good to start thinking about what’s next. So that’s often where Judd will offer some guidance about managing your cash flow while saving up for retirement.

How To Approach Retirement

There’s a couple of ways to approach setting up the right retirement plan. First, you need to consider what kind of business structure you are working with. If you have a solo practice, saving for retirement will be a lot simpler to figure out. If you have a group practice, things are going to be more complicated. However, both will have great opportunities. A great way to start is with small and simple things. As time goes on, you can really be more methodical and look at every possibility. Hiring therapists can be challenging when there is a mental health crisis. So, you may want to offer therapists a 401(k) option as an incentive. Even as a small business, you can create a 401(k) that feels just like what a fortune 500 company might have. Later, you can start thinking about a pension plan.

SEP IRA & SIMPLE IRA Plans

Judd recommends a few different options when it comes to retirement plans. SEP (Simplified Employee Pension) plan provides employers a method to make contributions to the employees’ retirement and their own retirement. The SIMPLE (Savings Incentive Match Plan for Employees) gives employees a way to make salary reduction contributions, and the employer makes matching or nonelective contributions. Each plan has a limit on how high you can go. SEP goes a little bit higher, and there’s less flexibility with this plan – everyone is going to get the same percent. Any financial planner or accountant can help you figure out which plan is right for you and your practice.

Why You Should Consider A Roth IRA

The Roth IRA was introduced for people who are early in their career or for people who do not want to save. Some of the regular IRA plans are not that helpful when you are in a lower tax bracket. When you put money into the Roth, you don’t get any deductions. However, that money is going to grow for years and years. When you take that money out, it’s going to be completely income tax-free. That’s going to be tremendous savings; it’s a powerful tool. If you’re newer to your career and you want to start saving money, Judd highly recommends starting a Roth IRA.

Gordon Brewer 0:00 This is the practice of therapy podcast with Gordon Brewer, helping you to navigate your private practice journey. This is session number 179 of the practice of therapy podcast. Hello, everyone. Glad you're with me. Glad you're joining me for the podcast. And if this is your first time listening in, glad you found us glad you're with me on this journey and hope you'll take time to subscribe to the podcast. So I'm looking forward to hearing from my guest today, Jed Carlton, Judd is a financial planner. And so we're going to kind of take a deep dive into retirement planning. I think for maybe for a lot of my listeners that might be kind of in in under the age of 40 or so retirement might not be on your radar. But as I like to say if you'll listen to this old fart or this old fogy, it's something you need to pay attention to I'm at that age where it's on my radar right now. But the sooner you start, the better off, you're going to be in the long run. Even if it's just a tiny bit that you save towards your retirement, it's going to make a big difference in the long run. And also, we talked about some of the things around if you've got a group practice about creating either 401, K's or some sort of retirement plan within your practice. So I think you're gonna find this a very interesting episode of just thinking about those things. Because it will get here eventually, and you do need to be prepared because he can't work forever. So anyway, before we get to Judd, I'd love for you to go over and check out our free resource that we have available. And it's the solo to group practice webinar. And in this particular webinar, it's a free webinar, I joined my good friend, Dr. David Hall. And we talk about some of the the ups and downs of starting a group practice and really things that you need to think about if you're considering starting a group practice. And even if you already have a group practice, I think our conversation together and the things that we cover in this webinar would probably be pretty helpful for you. But if you go over to practice of therapy.com slash group, you can register to watch that webinar. And in many ways, that's an on demand webinar in the sense that you get to schedule the time you want to watch the webinar. And it's about 60 minutes long. And it would just cover some of the pitfalls of starting a private practice, but all also some of the mistakes we've made along the way, but also the advantages of having a group practice and the various things you need to think about. As you move into group practice going from us being a solo provider to a group practice owner, David and I have learned a lot the hard way along the way and you don't have to so be sure and check that out their practice of therapy.com slash group and and be sure and watch the webinar to the end because we got some special discounts and bonuses that you can get, but we don't disclose those until you get to the end of the webinar. So be sure to check it out. Practice of therapy.com slash group. And also, before we get to Judd, be sure to check out therapy notes therapy notes will absolutely reduce the stress in your practice. They are the leading Electronic Health Record system for mental health providers in private practice. They're also one of the most highly rated of any out there. They have on their platform, the ability to schedule clients to send reminders. Also they have you can file your claims electronically with insurance companies. They have a telehealth platform as well. That is all built in along with a patient portal that is second to none where you can make you can literally go paperless within your office through that platform. So be sure and check it out therapy notes.com And if you'll be sure and use the promo code Gordon just Gio ARD Do we and you can get two months of those services for free, and try them out. So be sure to check them out therapy notes calm. And so without further ado, here's my conversation with Judd Carlton about financial planning and retirement. Hello, everyone, and welcome again to the podcast. I'm so happy for you to get to know Judd Carlton, and just when it was a person that had reached out to me, and we're going to be talking about just some financial planning stuff, and retirement, which maybe for some folks isn't quite on their radar yet, but it needs to be so Jared, welcome. Glad you're with me. Judd Carlton 5:54 Gordon Brewer 5:55 Judd Carlton 6:11 Gordon Brewer 7:27 Judd Carlton 8:07 Gordon Brewer 10:19 Judd Carlton 12:03 Gordon Brewer 15:18 Judd Carlton 16:23 Gordon Brewer 20:51 Judd Carlton 21:46 Gordon Brewer 24:33 Judd Carlton 25:42 Gordon Brewer 26:00 Judd Carlton 27:04 Gordon Brewer 27:31 Judd Carlton 27:35 Gordon Brewer 27:50 Judd Carlton 28:06 Gordon Brewer 28:39 Well, folks, I hope you enjoyed listening to my conversation with Judd. It really is something that you need to keep on your radar screen and be aware of, particularly as a private practice owner, and particularly being self employed. I think for those of us that have worked like in agency settings or in other places where they provide some sort of retirement benefit. We're, you know, later in life, we're pretty glad to have have had that and so, when you may, especially for those folks that might move out of agency work or working for some somebody else. That is something you want to continue to contribute to and continue continue. need to do as a self employed person and, and as a group owner. And I think it's also just makes a group practice much more attractive to hiring quality therapists when you can offer offer those benefit. So be sure and check out Judds website and that is glasner Carleton financial.com. And again, there should be links here in the show summary in the show notes. So you can find out more about that and maybe connect with him about just some financial planning. But whoever you find, I would say, think about it and something you should do. Because believe you me, it will be something that will be important for you in the future, not only for you, but also for your family. So be sure to check that out. And also, before you go, be sure and check out the solo to group practice webinar. And again, that's a free resource that you can find over at practice of therapy.com slash group. And you can sign up for that automated webinar. And also, get maybe some questions answered about going into group practice. So be sure to check that out. Practice of therapy.com slash group. And also be sure and check out our sponsor therapy notes therapy notes.com. As I've said before, they are the leading Electronic Health Record system for mental health providers in private practice, they are the most highly rated of all any of the EHR is out there. And they will absolutely make running your practice much easier. And help you to automate so much within your practice. So be out Be sure and check them out. Therapy notes.com. And be sure and use the promo code Gordon, just g o r, d o n, and you can get two months of their services for free. So thanks again for joining me for the podcast. As I said before, be sure and take time to subscribe to the podcast wherever you might be listening to it. And also leave us a rating. I love getting feedback from folks and being able to know how we're doing and how also gives us some direction of things that you're looking for. So be sure to subscribe, wherever you might be listening to it. So take care folks, again, I've got a lot of great guests scheduled ahead. So that's another reason to subscribe to the podcast so you can get notifications on that and try to have the podcast out every Monday morning. So look forward to you joining me again next week. You have been listening to the practice of therapy podcast with Gordon Brewer. Please visit us at practice of therapy.com for more information, resources and tools to help you in starting building and growing your private practice. And if you haven't done so already, please sign up to receive the free private practice startup guide at practice of therapy.com. The information in this podcast is intended to be accurate and authoritative concerning the subject matter covered. It is given with the understanding that neither the host guests or producers are rendering legal accounting or clinical advice. If you need a professional, you should find the right person for them.

This episode is brought to you by the solo to group practice webinar. It's a free webinar that you can find at practice of therapy.com slash group, and also brought to you by therapy notes therapy notes.com.

Thanks, Gordon. I'm happy to be here.

Yes, yes. So, as I start with everyone, why don't you tell folks a little bit about your journey and how you've kind of gotten interested, as a financial planner gotten interested in, in Canada, the niche of therapists, okay, absolutely. So

I've been a financial planner for about 16 years, and started off in a very large firm, and then developed and eventually became independent, and joined a practice that had been around for about 30 years, and become the owner of that practice, and just very fortunate to have a wonderful clientele. And that was a lot of people already in place. When I got started. And and more and more throughout the years. And in the way that I started working with therapists. It really happened organically, it's more like it, I realized that that had already happened when I was being a bit retrospective about what does my practice look like? And I you know, I thought about those relationships, because they become very meaningful, and realize that I just really enjoyed working with those clients and decided that I would like to do something to, to also give back to them beyond the financial planning and investment advice. And so I began putting some stuff out there.

Right, right. Yeah. And I know, that's something that is spin, kind of on my radar, not to give too much away around my age, but I'm in that category where retirement is on the horizon. And, you know, fortunately, you've done some pretty good planning around that, and that sort of thing. But I know for folks that might be kind of early on earlier on in their career, that's something that might not be quite as much on the radar. And so you want to talk just a little bit about maybe your process for helping people think about retirement and just financial planning in general.

You know, a lot of it is where where is the, the investor in the moment. So if you're fairly new, you know, one thing that I really admire about the therapy as a profession, is it takes so much just to get started. And oftentimes, by the time I'm talking to a therapist, they've really achieved what they set out to achieve, you know, you've been through the education, and the training built up that experience. And now you're ready to ask that question. Okay, this is, this is great, I've done this, like hard work. And you know, what the tendency is to, to make sure you've covered all those bases. And, and once you've done it, sometimes you can become comfortable. And it's important to start thinking early, because in the world of investing time really is on your side, when you have a lot of it. And and the earlier you get started, the better things are gonna work out for you because of the power of compounding. And what that can mean, you know, even starting five years or 10 years sooner, can really make a huge difference, even starting small with whatever you can. So that's something that's important. Yeah. And so, so kind of talking and coming to an understanding, too, about what what resources are available for investing. Yeah, because as you as you change and you develop in your career, especially as you you might jump from an employee role to a self employed role, you know, the complication really, really accelerates. The wise choices to be conservative, right. You never want to have an issue or feel stressed about about money or heaven forbid, bounced check. Once you cross those hurdles, it's good to start thinking about what's next. So that's often where I'll offer some guidance about how to manage that cash flow. All worked hand in hand many times with, with a therapist, accountant to really make sure you know, okay, what what needs to be saved to cover taxes and for regular cash flow? And then what actually is available to put away for retirement? And then even then what is the best way to do it? And there's so many different choices you can make in

that regard. Right? Right, yeah, something that I kind of, not necessarily harp on. But it's just something that I've learned along the way, and just not only in my own practice, but just working with others, one of the things that is just really a gift to yourself, to some degree, is to really create a reserve within your practice. Another words, I recommend, you know, at the very least three months of expenses, and taxes and your own salary, and, you know, everything, at least three months of that in reserve, so that, you know, if nothing happened in your practice, which is not likely, but if you you know, if you got sick or something where you had to draw on a reserve, it would be there, and you wouldn't be under that pressure at the time. But the other thing is just, I've thought about is, I think that's, that's really immediate, kind of more present moment kind of stuff. But really thinking long term. And this is, as I said, this has been something that's been on my radar first, you know, within the next 10 years, I plan to retire. And so I'm, you know, I'm thinking about and looking at what it's going to take for me to do that. And so, yeah, you're exactly right, I think the sooner you can start, the better, the better would be so. So, with that in mind, you know, what, if somebody is thinking about wanting to start, get started with creating a retirement plan? How should they go about that? And how should they find the right person?

A good way to approach setting up the right retirement plan? There's a couple sides to it, one, you need to know what is the structure of your business really, from a staffing point is pretty is a really important question. How is it if it's a solo practice, it's actually going to be a lot simpler to figure it out. If you have a group practice, it's going to be more complicated, both have great opportunities. But But that's an important question. And then and then also budgeting for it is, is there is that can make a big difference. And if it goes, it's you can start small and keep things very simple. And, and that's great. But if you if you're looking at things more like Geez, I, my income is doing really well. I am paying a lot in taxes, is there a way where I can get some tax advantage. And yeah, then then you want to really be more methodical and looking at every possibility. If you've got staff, then it opens up. Some more opportunities, but also some more challenges and complication. You know, I'll just throw out some some ideas for that. And one thing lately, especially with group practices is it can be a challenge to hire. And I'm hearing that in all kinds of industries. And so, you know, just the other day, I was on a call with an employer who was looking at their 401k, which hasn't been set up yet, but they want to offer that as as an incentive. And so you can structure it all different ways. Many times it's what can I do to save on tax, and you know, at with the bare minimum of expects, on the other hand, and maybe I want this to feel like a real benefit for my staff and for myself. And and you can actually, as a small employer, even with a handful of staff, or just for yourself, create a 401k that feels just like what a fortune 500 company might have, there's a little more complication a little more expensive, but it's out there, you know, with technology these days, you can really have anything you want. And then and then on the extreme side that let's say you're getting closer to retirement, you've been full for a long time and your incomes great, maybe you're you know, your all time high. And the 401k maybe that you've had in place for a long time, feels like I wish I could do even more. That's where you can start thinking about things like defined benefit plan a pension just for yourself. You know, it's not just for the, you know, the big companies, you can do that as a self employed a solo practitioner, you can do that with a group practice and might even work out so. So when you have a sense of just how far you want to go, if you need deductions, or if you're many people these days are aware of the Roth as a 401k or an IRA, if you're focused on that. Maybe you're newer in your career. You can do all that. So know where your priorities are. And that's where you can reach out to a financial planner, who can sort of take that match it up. analyze it with the spectrum of what kind of plans are available, and and then move towards a decision. And ideally, you'd have a lot of help with implementation because certainly these plans can can be a bit complex and may involve other third parties to get them set up. And then and then there's ongoing, you know, work to keep it in place.

Right, right. Yeah. So, you know, recently I got to, one of the things that got a little bit of pride around is that I was able to set up retirement benefits for my employees and my practice, and it's just a one, which, and there's your right when I start started talking to my financial planner, there were just a lot of options to kind of sift through, but the one I ended up landing on for, at least for my practice, which is a smaller, smaller group practice was just a simple IRA, where I actually match a portion of what they contribute to their own retirement plan. And it's just, I think it's really appreciated by the employees. But you may be judged, if you don't mind, can you kind of run through? I know, there's probably about four or five different ways you can set up. And I might be exaggerating retirement plans for for employees, you want to kind of run through some what some of those are.

Yeah, sure. So let's start with the one that you mentioned, the simple, you know, that that's great. That's, that's very straightforward, it can be done fairly quickly. So you've been through it. And you got, you got a couple of nice features there, which is that the every participant, including the owner, yourself, right, you can make your own contribution. And then as the owner, you can also contribute on on behalf sighs the employer, right, you can contribute on behalf of the staff, which can be a really nice benefit when you want to do that. And, you know, one thing I love about it is that it's, it's something that lasts, you make that contribution, and you tell them about it. And that's great, that's nice in the moment, but then, as time goes on, you've seen that grow. So I mean, that's really true across the board with these kinds of plants, I'd say an alternate that is often assessed at that time is more common for self employed, I mean, salary solo would be a step in difference between the simple and the set is basically the set let's The, the employer put more in. So there, you should have these types of plans has has a limit on how high you can go. So the Sep goes a bit higher, the Sep is also going to be employer contributions. And there's also a bit less flexibility there, the everyone's going to get the same percentage. So so you have to do a calculation, it can also be a little tricky, often, we'll end up having to look at that closely. Once you know your numbers for the whole year for everyone, especially if you've got some staff that may be you know that the income is a little more lumpy, you know, maybe they work one month, not the next or something like that. So you got to keep an eye on it. Then let's see the next thing that that I would say after that would be then you're thinking about a 401k. So So CEP versus 401k, is I frame it that way, because that's often how big account in my frame it they often will suggest a set because it's it's extremely easy. A 401k is going to require some more record keeping the one of the benefits that I like about the 401k, especially if you're if you're solo practitioner, is you, you can get more into the plan at a lower income level. So there are formulas about it, any financial planner, or accounting can help you figure it out or on change and also have some more flexibility, especially if Roth is of interest. And for these days, especially we were hearing that tax rates might go up for some of us, the Roth is a real focus. Or if you this this comes up pretty frequently, too, is let's say you have a year where income is a bit lower, you took some time off something like that, that can be an opportunity to make a Roth contribution instead of that traditional tax deductible contribution. That's something to look at to also with the 401k structure. Sometimes it's important that people for their liquidity to be able to take loans from that plan 401k can allow that seps don't do that. So I like that a lot. Also the the interface tends to be something that can really have a lot of other features tied into a planning advice projections, which can be really useful when you're thinking long term. So that's on the 401k side. So there we've got we've got simple Sep 401k A Roth 401k and then the fifth one, right? That's where you can talk about like pension accounts. And you know that that can get complex in terms of how exactly do you make it happen? And it's got filings that you do, you need an actuary, but the the sort of punchline about pensions, is, you know, in all these other types I'm talking about, you might, you might get up to, you know, in some cases around 15,000, the biggest, you know, deduction you could get, you move up the scale with the 401k, maybe can get, you know, a bit over 50, close to 60,000. In, you know, and for some people that that's not enough. So if you feel like that's not enough, that's when you think about what can I do with a pension account? And then you can really go much, much higher.

Right, right. Yeah, it's a Yeah, when you when you start, I'm sure there are folks out there, as you were mentioning, all those different, different ways to create a retirement plan, they're kind of their eyes glaze over. But, you know, I think that's where it's really important to talk to a professional, and kind of kind of get to know your options, and really get some advice, where they understand your financial situation and, and understand your practice and kind of how you're structured to really kind of give the best advice on which one to choose, because it is a commitment to do those things. You want to maybe explain the difference between an IRA and a Roth IRA, because I think that that's a term that we hear a lot is just a Roth IRA, you want to explain a little bit about what that is?

Yeah, sure. So I would say, for a little background, you know, there's this, there's this problem that we kind of all face as, as workers who many of us were starting at the lower end of the scale in our fields, and just naturally over time increase in what often happens is, in the years just before retirement, that will often be your highest income 1015 years before retirement. And the problem, you might have this, when you first started, you're at a very low tax bracket immediate have as much so it felt substantial, but it was a lower percentage, as you move on through your career, you end up paying a much higher percentage of your income. And and it's kind of painful, because that's when you need to save the most, because you're about to retire. So so the government actually came out with a way to smooth out this tax problem, that's where the whole concept of these tax deductible retirement plans came from. So that so that when you're close to retirement, and you're at a high income, you put money into these special plans, you get a tax deduction at that time, when you would have paid a lot. And then when you do retire, and you start to take the money out, you're probably in a lower income situation, and you're going to pay less tax. So it's, it's a way to smooth out that or that that ride where otherwise you might have been paying a lot just before you need it. So that's the idea. That's what would be the traditional IRA, traditional 401k. What came about years later is there are these moments in a lot of careers where it goes the other way. And maybe you have a couple of years where you're not working or, or anything could happen, you know, could could be for medical could be just personal reasons, take a sabbatical anything. Or when you're early in your career, and you do want to save, it's not that helpful to use the regular types of plans when you're in a very low tax bracket. So that's where the Roth came out. The Roth is a different deal. It's when you put money into it, you don't get any deduction, but it's going to sit in that account all the money there, it's going to grow with your investing wherever you went, stocks, bonds, whatever you did, and years and years, decades, in the future, when you take that money out, it's going to be completely income tax free. So that can be a tremendous savings, you know, you may, you may have had time to make a very large game, years and years of contributions. And so that can be really powerful. Especially for for, for people who are newer in their careers. If they want to stay by that, they'll recommend starting with that. And then eventually, as the income grows and the taxes grow, you may switch over for a period of time to the traditional and get those deductions.

Right, right. Yeah. So a lot it's a lot to think about. And again, I can't reiterate enough to talk to a professional about it. And and for those that are getting started in private practice, I would, I would say, you know make this a priority. This needs to be be on your radar now because like you said earlier, just being able to use the power of Tom sounding really, really is pretty amazing. I read, I'll share this, I had, when I had worked for an agency, they had our retirement plan. And so when I left the agency, I just stuck it over in an IRA and I haven't, I really don't look at it. I mean, I just really kind of just leave it, leave it be so to speak. And the other day, he just thought, Wonder wonder how that's doing. And I was just really pleasantly surprised how much it had grown. Since I had put it in there. Of course, as we're recording this, the stock market's doing really well right now. So I think there's probably a little bit of reflection of that in there as well,

you're in a in a field where you really do have to put a lot yourself throughout the day every day into it. And to have something that can really appreciate it like that in a fairly hands off way is and then and then just grow so much and do so much for you when you're ready to retire. Right?

Right. And then, and then just the whole not to get too deep into the weeds with this. But the whole magic of cost averaging. You know, as the stock market goes up and down, what you want to do is, is invest, you know, in a mutual fund or stocks or whatever, and again, a financial planner can guide you on all of that of knowing where to invest and, and really not putting all your eggs in one basket. But with the cost averaging thing as the stock market fluctuates that kind of counteracts that along the way so but you do want to be consistent with it. And, and, and think about it so. So well, Judd, I want to be respectful of your time. And this has been great. And I think this is going to be just a really helpful episode for people. You want to tell folks how they can get in touch with you if they have more questions and maybe just a little bit more about your financial, your your financial business,

you can find information about me at my website, which is glasner, Carleton financial.com. And I've got my blog there too psyched up about money with a lot of great info geared towards therapists. And all my contact info is there as well. And anyone who'd like to reach out to me, you can contact me through that website, shoot me an email, give me a call. We'll schedule some time.

Right, right. You want to say a little bit too about your YouTube channel?

Oh, sure. Yeah, that's where I've got a bunch of videos on topics. Yeah, I've got Gordon on there. That was a fantastic interview. And yeah, you can the link through that probably best just to go straight through Alaska, Carlson financial calm.

And we'll have it we'll have all those links here in the show notes and show summary for easy easy access. So yeah, so as we close, Judd, what would you want most therapists to know that you feel like is important, just around this topic,

Gordon gave great advice, which is make sure you're covered for anything that might come up in a three month period, maybe even a little longer. If you know, you're the conservative type and you want to be safe. When I'll say this, you know, we all have a tendency to think, well, if a little bit is good, a lot, it's got to be better. But at a certain point, he might end up holding yourself back on your long term goals, especially because it it takes a lot. It takes a lot to be able to retire comfortably. Anything you can do to get some tax advantage and just get your savings working for you. You should do it. So don't delay,

right. Yeah, yeah, that just opens up a whole other topic of learning to outsource and how to invest in your practice of, you know, it's good to say, but you don't want to just hoard it all, all down to really kind of hinder your growth. So, yeah, so well, Jared, thank you so much for being on the podcast. And I'm sure we'll have more conversations in the future.

Being transparent… Some of the resources below use affiliate links which simply means we receive a commission if you purchase using the links, at no extra cost to you. Thanks for using the links!

Judd’s Resources

Email Judd: jcarlton@royalnj.com

Judd’s Website

Judd on LinkedIn

Judd on YouTube

Resources

Use the promo code “GORDON” to get 2 months of Therapy Notes free.

Use the promo code “GORDON” to get 2 months of Therapy Notes free.

Solo to Group Practice: Adding More Therapists to Grow Your Time & Income

Money Matters In Private Practice | The Course

Get your FREE Financial Analysis Guide…

Google Workspace for Therapists | The E-Course

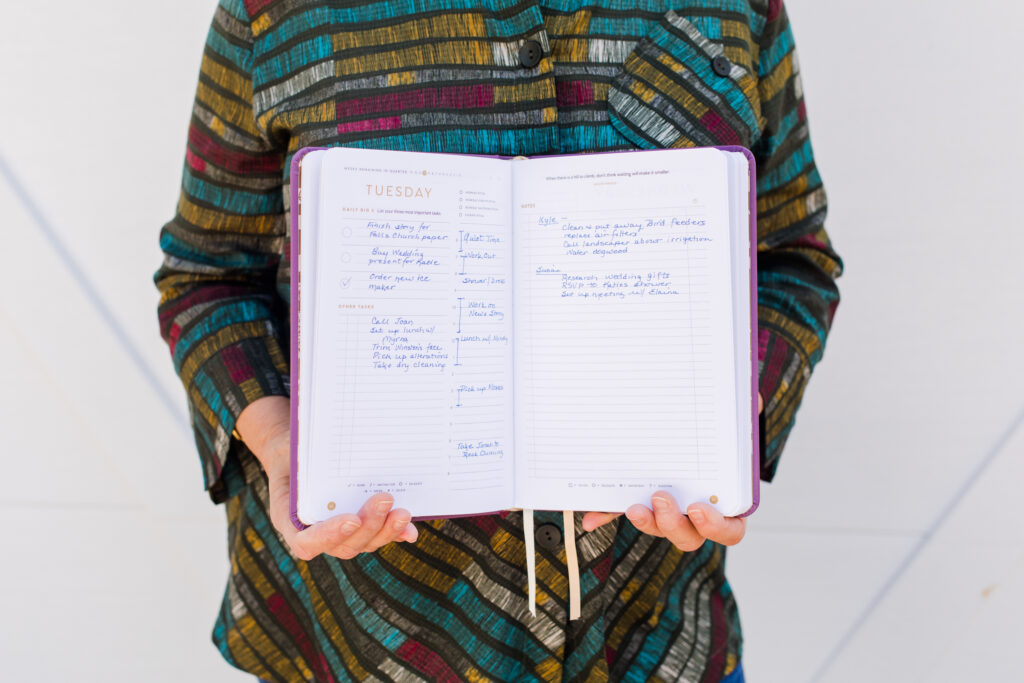

Purchase The Full Focus Planner™

Join my Focus Groups

Session Note Helper 3.0

Join the Google Workspace for Therapists Users Group

Cool Resources

Follow @PracticeofTherapy on Instagram

Meet Gordon Brewer, MEd, LMFT

Gordon is the person behind The Practice of Therapy Podcast & Blog. He is also President and Founder of Kingsport Counseling Associates, PLLC. He is a therapist, consultant, business mentor, trainer, and writer. PLEASE Subscribe to The Practice of Therapy Podcast wherever you listen to it. Follow us on Twitter @therapistlearn, and Pinterest, “Like” us on Facebook.

Gordon is the person behind The Practice of Therapy Podcast & Blog. He is also President and Founder of Kingsport Counseling Associates, PLLC. He is a therapist, consultant, business mentor, trainer, and writer. PLEASE Subscribe to The Practice of Therapy Podcast wherever you listen to it. Follow us on Twitter @therapistlearn, and Pinterest, “Like” us on Facebook.