This episode of the Practice of Therapy Podcast is the first of a two-part series interviewing Mike Michalowicz, the author of Profit First and Clockwork. Gordon is also joined by Kasey Compton and they both interview Mike about the Profit First concept and how it can help clinicians in their private practices and make them more financially secure. They also talk about honing your systems and processes to make your practice run itself rather than having it “run you”. Listen in to this fun interview and Mike’s knowledge about entrepreneurship and being a small business owner.

In part one of this interview, Mike focuses on how he came up with the Profit First system and some other ways of thinking about business finance to help us pay ourselves first AND make a profit.

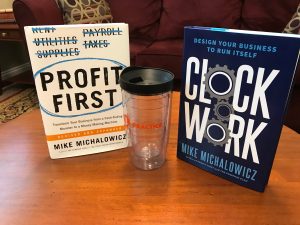

Enter the book giveaway here!

Meet Mike Michalowicz

Mike mi-KAL-o-wits is the author of Profit First, Surge, The Pumpkin Plan, and his newest release Clockwork. By his 35th birthday, Mike had founded and sold two companies – one to private equity and another to a Fortune 500. Today he is running his third multi-million dollar venture, Profit First Professionals.

Mike mi-KAL-o-wits is the author of Profit First, Surge, The Pumpkin Plan, and his newest release Clockwork. By his 35th birthday, Mike had founded and sold two companies – one to private equity and another to a Fortune 500. Today he is running his third multi-million dollar venture, Profit First Professionals.

Mike is a former small business columnist for The Wall Street Journal and the former business makeover specialist on MSNBC. Over the years, Mike has traveled the globe speaking with thousands of entrepreneurs and is here today to share the best of what he has learned.

Mike’s Websites

Clockwork.life – Get the free clockwork kit!

Website – www.mikemichalowicz.com

Mike’s Books

Full Disclosure: these links are affiliate links which simply means we receive a commission at no extra cost to you when you buy using these links. Mike and I thank you for purchasing his books! You won’t regret it!

[amazon_link asins=’073521414X,0525534016,0981808247,1591844886,0981808204′ template=’ProductGrid’ store=’POT Sales’ marketplace=’US’ link_id=’51e13632-aef3-11e8-9c80-4d9e70981c88′]

Understanding the Financial State of Your Practice

Mike was able to create a system of looking at and tracking your business finances in a way that is simpler and a more intuitive for those of us that are non-accountants. Most people in small business, unless they are an accountant or have had some other financial training, find all of this very intimidating or confusing.

For most people, we tend to look at our bank balance as a measure of our practice’s financial health. And most accountants will tell you that is NOT the way to measure things. Instead, we need to be looking at our profit and loss statements, cash flow statements and balance sheets. Mike said his accountant “implored him” he should also learn about the KPI (key performance indicators) and OCR (operating cash ratiometric); all of which seem terribly intimidating for the average business owner.

The other thing most practice owners and small business operators do is take what is left, after all the bills are paid, to pay themselves and make a profit. They are living on the leftovers, rather than paying themselves first and/or making a profit in their business. But in order for any business or private practice to survive and be sustainable, it HAS to make a profit.

Profit First

With Mike’s “Profit First” system, he turns conventional wisdom on its head and gives us another way of thinking about how we manage our finances and look at profit. The traditional way of thinking about making a profit is this:

Income -Expenses = Profit

It’s what we get to keep after everything else is paid for; operating expenses, salaries, and taxes. The problem is that the bigger we grow, the more our expenses grow too. It becomes a never ending cycle that keeps our profitability at bay and keeps our businesses unhealthy. Mike says this line of thinking is kind of like saying, “my health comes last”

Mike says that a better way is to allocate our profit first rather than let our expenses and operating costs determine what we get. The premise is to allocate a percentage of the income on the front end for profit. It looks like this:

Income – Profit = Expenses

This, of course, seems like unconventional wisdom. Mike goes on to explain that by taking our profit first we are better able to take control of our business’ health and operate at a level that is more sustainable and realistic.

AC/DC Concept (Not talking about the rock band this time…)

One of the things any business or private practice needs to do in order to scale and grow is put the systems in place that allows the business to run itself. Mike talks about the four phases of business flow that most all businesses depend on in order to be viable. These four phases (or systems) are:

- Attract – Getting clients interested in using our services.

- Convert – Clients make an appointment and commit to using our services

- Deliver – We hold our sessions with clients and deliver our services

- Collect – The client pays us for our services and/or we collect from third-party payors

Mike says that when a business is struggling, it is usually because one or more of these four systems is not working well. It’s kind of like a chain. Find the weakest link and fix that and the business will begin to grow on thrive.

Profit is Usually The Easiest Thing To Fix

Kasey mentioned that when she is working with practice owners and looking at their financials, she says that a lot of times everything looks good on the surface, but the profit is off. She says that profit is easy to fix if we take our profit first then let everything else fall into place based on the principles mentioned above.

Maslow’s Hierarchy of Needs

We are familiar with Maslow’s Hierarchy Of Needs. We all need our basics first. Down to the very basics such as oxygen, food, water, shelter, etc. In business, “sales” is the oxygen. If a business is not bringing in any income it cannot survive and quickly suffocate. Mike says, “profit is the food”. Profit is what sustains a business and keeps it healthy. Without profit, a business will starve to death.

Mike said, that the tendency of most businesses is when they are struggling is to push for more sales. But that is kind of like giving it more oxygen when what it really needs is more food…profit.

The solution he says, is to start allocating a profit on the front end (little bits of nutrition) and then operate on the remainder. It’s an unconventional way of thinking about it, but what it does is to force the business to operate within its means and stay healthy.

Making a Behavioral Shift

What this does in essence is to “force” better control of our expenses by making a behavioral shift using what Mike refers to as “Parkinson’s Law” (not like the disease, it’s a different Parkinson…). Parkinson’s Law essentially says, that as the availability of a resource increases, so does our consumption of that resource.

Think about your tube of toothpaste… when we have a brand new tube we generally put more toothpaste on our toothbrushes because we know there is more than enough needed for that brushing. As we get down toward the end of the toothpaste tube and we are squeezing and squeezing to get the last drop out, we are willing to use less so we don’t have to get another tube of toothpaste.

Mike says what we need to be doing instead with our operating expenses, is to adjust our business to operate within the means of what has been allocated for operating expenses. In other words, treat the full tube of toothpaste like it is nearly empty without skimping on brushing our teeth; paying ourselves and making a profit.

Using Our Money Differently Empowers Us

When we start setting aside our profit first it takes the pressure off. When we give ourselves permission to get away the “hustle and grind” and trying to grow based on size and the amount of revenue coming in. Instead, let growth take place based on how we allocate the money we have coming in. Mike says he has known several large businesses that were bringing in a lot of money, but they were not profitable.

He believes that we can find the what works for us and that the right size business will find us. Revenue can be a stress factor. For every dollar we take in, we have an obligation to deliver a service in return. Eventually, this does have the potential of becoming overwhelming. The remedy is to instead make your practice profitable instead of trying to chase more revenue.

“Let your right size business find you. What feels good is right…”

In the next episode, we will focus more on systems and talk about Mike’s newest book, Clockwork…

Watch The Full Interview

Meet Kasey Compton

Kasey built a million dollar practice with over seventy-five staff members in less than two years from the ground up. She is the President/CEO of Mindsight Behavioral Group with multiple offices located in Kentucky. Kasey says, “it definitely wasn’t easy but I learned a lot scaling a practice”. She is now in year three and her business with basically running itself; largely due to the systems and processes we put into place.

Kasey built a million dollar practice with over seventy-five staff members in less than two years from the ground up. She is the President/CEO of Mindsight Behavioral Group with multiple offices located in Kentucky. Kasey says, “it definitely wasn’t easy but I learned a lot scaling a practice”. She is now in year three and her business with basically running itself; largely due to the systems and processes we put into place.

Now, Kasey is a behavioral group consultant(www.consultwithkc.com) and author that helps practices avoid mistakes by cleaning up their systems, implementing better processes, and understanding what to do with their money. Kasey says, “ I take so much pride in my own practice and now I feel honored to help others grow too.”

Meet Gordon Brewer, MEd, LMFT

Gordon is the person behind The Practice of Therapy Podcast & Blog.He is also President and Founder of Kingsport Counseling Associates, PLLC. He is a therapist, consultant, business mentor, trainer and writer. PLEASE Subscribe to The Practice of Therapy Podcast on iTunes, Stitcher and Google Play. Follow us on Twitter @therapistlearn and Pinterest “Like” us on Facebook.